legal fees calculator malaysia 2018

Name of the Act Late fees for every day of delay. The facts that the children had acquired British citizenship and that the.

The Complete Guide To Buying New Subsale Or Commercial Property In Malaysia

Income Tax Calculator is Useful.

. 77 Best place and safest website to buy cheap Ruined King CurrencyRPRiot Points Top Up service for PCPS4Xbox One discount price ever biggest promotions. Income Tax Calculator Financial Year 2022-23 Article contains Automatic Income Tax Calculator in Excel Format for Financial Year 2022-23 FY 22-23 ie. Monthly rental received from each property is less than RM2000.

Here are the details of Late Fees and Interest under GST. Our fees listed on this page are for those applying for or renewing their passport in the United States and renewing by mail from Canada. You can use the calculator here to find out the applicable late fees and interest.

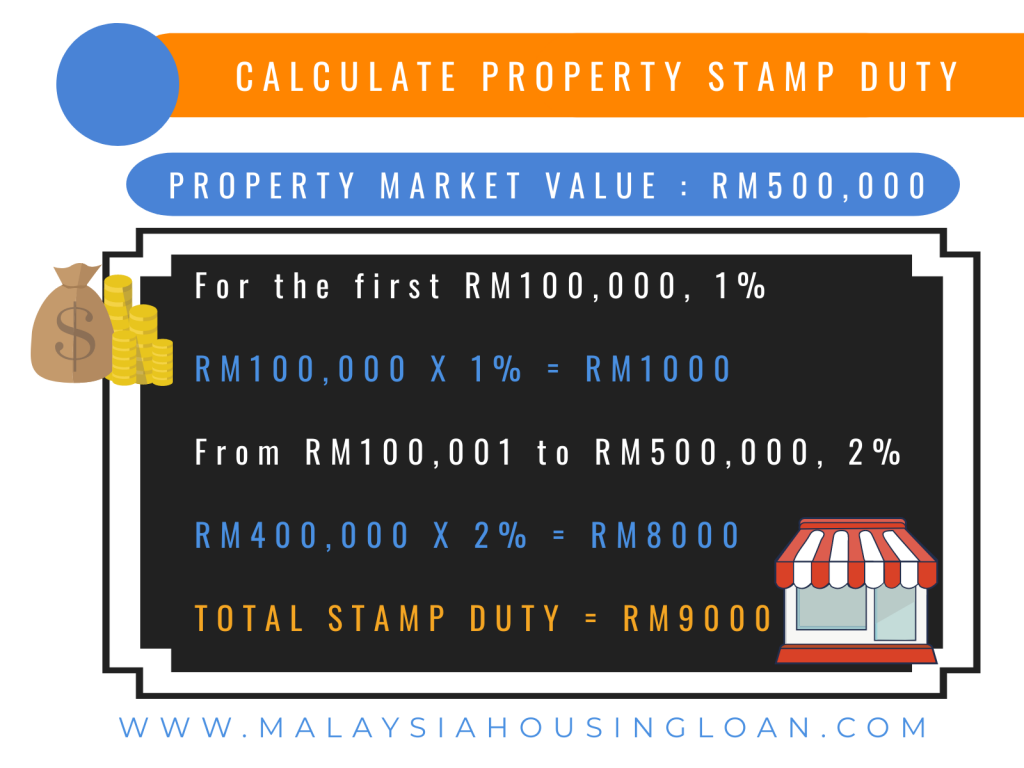

WesternFX is rapidly emerging as a leader in the Forex trading industry. The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan agreements dated 1 January 2019 or later and to sale and. Sep 9 2020 1212pm EDT.

If you need to apply for or renew your US. To qualify tax return must be paid for and filed during this period. In 2019 the IRS issued a safe harbor ruling for vehicles.

General Tuition Rates. Offer period March 1 25 2018 at participating offices only. Type of Vehicle - The vehicle type impacts the amount of the maxiumum depreciation that a taxpayer can deduct each year prior to 2018.

Today Amway manufactures over 350 products with manufacturing facilities in China India and the US as well as Nutrilite organic farms in Brazil Mexico and the US. Is It Time To. 2022-2023 Fall 2022 Spring 2023 and Summer 2023.

Central Goods and Services Act 2017. ClearTax GSTR-3B Interest and Late Fee Calculator. Legal fees for sale and purchase agreements and loan agreements are regulated by the Solicitors Remuneration Amendment Order 2017.

Award granted Bachelor of Laws Year. If you selects qualified asset 100 bonus depreciation then you should probably select safe harbor rules. 5 Unexpected Places To Find Your Next Great Business Idea.

There is a legal document Tenancy Agreement between the landlord and tenant. VTAC code 1400414061 - Waterfront Geelong Commonwealth Supported Place HECS 1400514061 - Burwood Melbourne Commonwealth Supported Place HECS. Cannabis Challenges Differ In Each State Where Its Newly-Legal.

Get the latest news and analysis in the stock market today including national and world stock market news business news financial news and more. Income Tax Assessment Year 2023-24. Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview.

For example the minimum water tariff in Malaysia for domestic use in Kuala Lumpur or Putrajaya is RM6. Rs 100 Respective State Goods and. Jun 21 2020 1107am EDT.

In Samuel Duraisingh Anor v Pendaftar Besar Kelahiran dan Kematian Malaysia and another case 2019 1 LNS 1474 the High Court held that the acquisition of foreign citizenship is not relevant when determining whether the children are entitled to citizenship by operation of law. After 2017 the maximum depreciation amount is the same for all vehicles. The Tenancy Agreement must be stamped by LHDN and put into effect by or after January 2018.

There is a. Looking for real-time price quotes on your favorite currency pairs. The minimum electricity tariff in Malaysia for residential use is RM3 while the low-voltage commercial tariff is RM720.

There is no limit to the amount of residential properties a landlord can have at this threshold. Amway was ranked as the 42nd largest privately held company in the United States by Forbes in 2018 and as the number one largest company on the Direct Selling News Global 100 list in 2018. Passport in another country visit the webpage of the.

For commercial use this amount is six times higher at RM36. The Fee Calculator the Fee Chart PDF or the Fee Charts below. Find your fee in one of three ways.

May not be combined with other offers. For GST annual returns GSTR-9 Edit.

Malaysian Tax Issues For Expats Activpayroll

Your Simple Guide To Perfection Of Transfer And Perfection Of Charge

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Maybank Housing Loan Calculator Clearance 60 Off Www Ingeniovirtual Com

Malaysia Tax Guide How Do I Calculate Pcb Mtd Part 2 Of 3

Car Loan Calculator Malaysia Apps On Google Play

Stamp Duty On Mot Stamp Duty Calculator Malaysia Malaysiacalculator Com

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Maybank Housing Loan Calculator Clearance 60 Off Www Ingeniovirtual Com

Calculators Legal Fee Sale Purchase Agreement Loan Agreement

Spa Stamp Duty Mot Calculator Legal Fees Calculator Properly

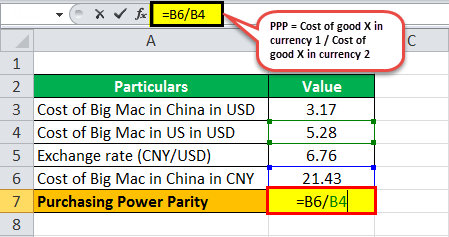

Purchasing Power Parity Formula Calculation Examples

Stamp Duty Legal Fees Malaysia 2022 For Purchasing A House

Simple Interest Calculator Audit Interest Paid Or Received

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Stamp Duty On Mot Stamp Duty Calculator Malaysia Malaysiacalculator Com

Purchasing Power Parity Formula Calculation Examples

Car Buying Legal Advice You Have To Know Car Buying Honda Fit Hybrid Honda Fit

Comments

Post a Comment